Small BalanceCommercial Loans

Nationwide non-bank private lender providing small balance commercial real estate loans, mixed use property loans, small balance multifamily loans, and commercial loans for apartment buildings with up to 65% LTV.

75%

Stabilized

value

Stabilized

value

10

Days or

less to close

Days or

less to close

$10M

Max loan

amount

Max loan

amount

Small Balance Commercial

Property Loan Requirements

Our small balance commercial lending team at Revolution Realty Capital has funded over $1 Billion in deals.

Our small balance commercial real estate loans offer no prepayment penalty, up to 75% of stabilized value, 65% in loan to value (LTV) ratio, and quick pre-approvals for fast funding.

- Loan Amount

- $500K - $10M

- Max Loan to Value

- Up to 65%

- Max Stabilized Value

- 75%

- Rates

- Starting at 10.5%

- Eligible Properties

- Retail, office, light industrial, self-storage, multi-family properties with 5+ units, and mixed-use properties (50%+ of square footage is residential)

- Number of Units

- No limit

- Personal Income Requirements

- None

- Prepayment Penalty

- None

Small Balance Commercial

Lending Nationwide

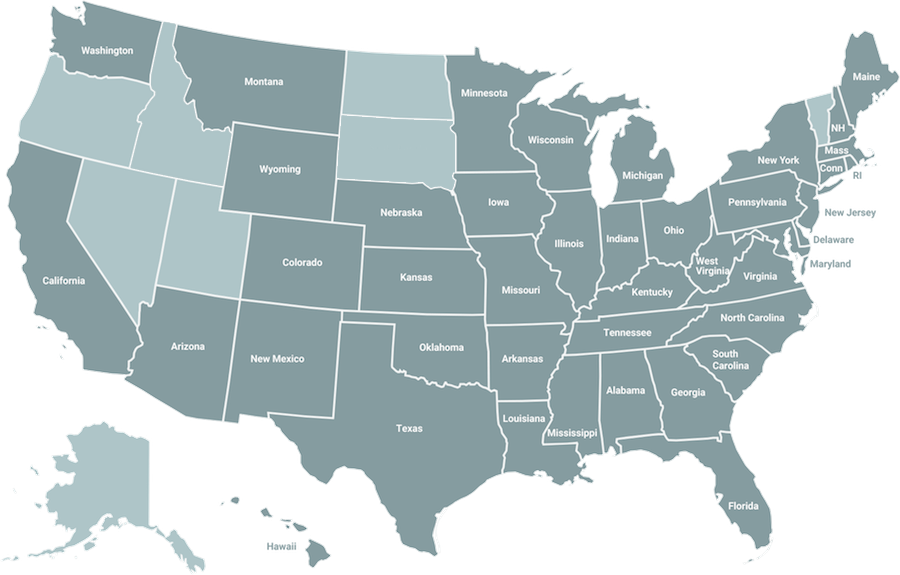

We offer fix and flip lending in 42 of 50 states including Washington DC.

Apply now for your small balance commercial real estate loans in:

How Mixed Use

Property Loans Work

Mixed use property loans — also called small balance commercial real estate loans, commercial loans for apartment buildings, and small balance multifamily loans — are designed for commercial real estate investments. Small balance commercial loans are a private financing option used to develop multi-family, mixed-use, retail, office, light industrial, and self-storage properties.

Small balance commercial mortgage lenders consider the following for investors applying for multifamily financing:

- Real estate investment experience

- Credit score

- Clean criminal and financial background

- Size of the down payment

- Liquid reserves

If you’re new to small balance commercial lending, read our guide on buying an apartment complex as a first-time investor.

Using Small Balance

Commercial Loan

Small balance commercial loans are an alternative to conservative bank lending. Direct small balance commercial loans provide fast funding to cover the cost of multifamily and mixed-use investment properties. Oftentimes, private mixed use loans for commercial properties are based on the ARV.

Typical ARV from small balance commercial mortgage lenders is 70%. At Revolution, we offer up to 75% stabilized value on private small balance commercial loans for proven borrowers.

Not an investor but looking to make huge returns on commercial loans for apartment buildings? Become a commercial loan broker with Revolution Realty Capital for access to industry-leading private mixed use property loans.

Benefits of Commercial

Property Financing

Private small balance commercial real estate loans create an opportunity for investors to earn returns from retail, office, light industrial, self-storage, mixed use, and multifamily properties faster than traditional bank lending.

Small balance multifamily loans from private lenders have a faster closing process than conventional loans, with less paperwork and more flexible underwriting, giving real estate investors the funding they need, when they need it for a wide range of property types with no personal income requirements.

Benefits of Revolution’s small balance commercial lending include:

- Fast pre-approval process

- As little as 10 days to close

- Up to 65% LTV

- Funding between $500K – $10M

- No prepayment penalty or exit fee

- Access to our state-of-the-art online platform for borrowers

- Nationwide lending in 42 of 50 states

If you’re ready to fund your small balance commercial project, apply now, and let’s talk about your deal.

We offer a fast and simple application process for our small balance commercial real estate loans.

Step 1

Step 1

Complete the form on the left to connect with our world-class team of small balance commercial mortgage lenders.

Step 2

Step 2

Our small balance commercial mortgage lenders will reach out to you in 24 hours with a funding solution customized to suit your specific deal.

Step 3

Step 3

Complete the application through our simple online small balance commercial lending platform to get approved

in as little as 10 days.

Best Small Balance

Commercial Loans

Revolution Realty Capital offers the best private small balance commercial loans for real estate investors. We offer up to 75% stabilized value, 10 days or less to close, and no personal income requirements with rates starting at 10.5%.

When you choose to fund your light industrial, retail, office, self-storage, mixed use, multifamily project with Revolution, you get access to our team of professionals with over 40 years of real estate experience and our intuitive borrower portal.

Explore More Private Loans for Investors

-

BRIDGEAcquisitionLearn More

-

TERMRentalLearn More

-

NNNBuild to SuitLearn More

-

REHABFix & FlipLearn More

-

GROUND UPConstructionLearn More

Learn About Mixed Use Loans for Investors

Not ready to fund your small commercial project? Gain knowledge from experts about how to become a real estate investor in our learning hub.