Ground UpConstruction Loans

Nationwide non-bank private lender providing construction financing and no doc construction loans up to 75% LT-ARV

85%

LTC funding

LTC funding

30

Days or

less to close

Days or

less to close

$20M

in funding

per project phase

($50M max on a case by case)

in funding

per project phase

($50M max on a case by case)

Construction Loan Requirements

Our team of construction loan experts at Revolution Realty Capital has funded over $1 Billion in loans nationwide.

We offer horizontal and vertical construction financing for eligible projects including infill, subdivisions, and master-planned communities.

Experienced builders and developers rely on us for industry-leading financing structures, speed of execution, and certainty of closing.

- Loan Amount

- Up to $20M

- Max Loan to ARV

- Up to 70%

- Max Loan to Cost

- Up to 85%

- Recourse

- Limited Guarantee Options

- Property Types

- SFR, Multifamily, Conversions

- Term

- Up to 24 Months

- Lien Position

- 1st Lien

- Rates as low as

- 10.49%

Construction Loan

Lenders Nationwide

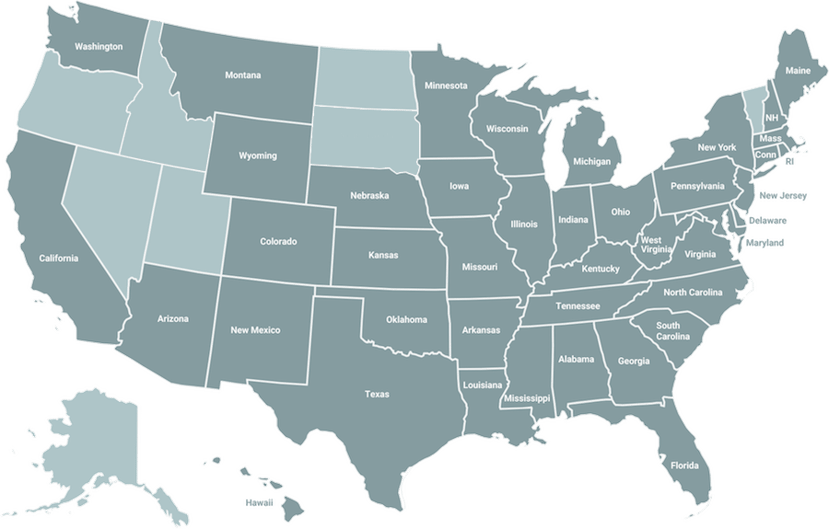

We offer private construction loans in 42 of 50 states including Washington DC.

Apply now for Oregon construction loans, Texas construction loans, commercial construction loans in California, and owner builder construction loans in Arizona:

How a Construction

Loan Works

Construction loans — also called a self build loan, ground-up development financing, and new construction loans — are designed for commercial real estate investments. Ground up construction loans are short term financing options used to develop non-owner occupied single-family, multi-family, and mixed-use propertied on a permitted or permit-ready lot.

Construction loan lenders consider the following for investors applying for construction funding:

- Successful track record with similar real estate investments

- Real estate development experience

- Credit score

- Clean financial and criminal background

- Size of the down payment

- Amount of liquid reserves

If you’re new to construction project financing, read our commercial real estate construction loans guide.

Using a Hard Money

Construction Loan

Hard money construction loans provide fast funding to cover the cost of building non-owner occupied investment properties on permit-ready lots. Oftentimes, hard money loans for ground-up development properties are based on the ARV.

Typical ARV from hard money construction lenders is 70%. At Revolution, we offer up to 75% ARV on private construction loans for proven borrowers.

Not a developer but looking to make huge returns on construction loan programs? Become a commercial construction loan broker with Revolution Realty Capital for access to industry-leading private-construction loans.

Benefits of Construction

Financing

New construction financing creates an opportunity for developers to earn huge returns developing small or large construction projects.

Typically, direct private lenders offer dispersed financing to borrowers with fixed amounts. For real estate investors, these favorable terms mean interest is only paid on the amount owed vs. the full project cost.

Ground up construction loans from private lenders have a faster closing process than conventional loans, giving real estate investors the funding they need, when they need it.

Benefits of Revolution’s construction project financing include:

- Fast pre-approval process

- As little as 10 days to close

- Higher LTC for proven borrowers

- Up to 75% ARV

- Funding between $500K – $5M

- No prepayment penalty or exit fee

- Access to our state-of-the-art online platform for borrowers

- Nationwide lending in 42 of 50 states

If you’re ready to fund your ground-up development, apply now, and let’s talk about your deal.

We offer a fast and simple application process for our ground up construction loans.

Step 1

Step 1

Complete the form on the left to connect with our world-class team of construction lenders.

Step 2

Step 2

Our construction loan lenders will reach out to you in 24 hours with a funding solution customized to suit your specific deal.

Step 3

Step 3

Complete the application through our simple online commercial construction lending platform to get approved in as little as 10 days.

Best Private Lenders

for Construction Loans

Revolution Realty Capital offers the best private construction loans for real estate investors. We offer higher LTC for proven borrowers, up to 75% ARV, 10 days or less to close, and no personal income requirements with rental property loan rates starting at 11.5%.

When you choose to fund your commercial construction project with Revolution, you get access to our team of real estate professionals with over 40 years of experience and our intuitive borrower portal.

Explore More Private Loans for Investors

-

RehabFix & FlipLearn More

-

BRIDGEAcquisitionLearn More

-

TERMRentalLearn More

-

NNNBuild to SuitLearn More

-

SMALL BALANCECommercialLearn More

Construction Loans Learning Hub

Not ready to fund your commercial construction project? Looking for inspiration for your ground-up construction investment? Browse our learning hub with resources and blog posts from on-the-ground real estate experts about best practices, how-to's, and learn more about the world-class team who services your construction loans.