CommercialBridge Loans

Nationwide non-bank private lender providing bridge loan lending and short term bridge loans near you with up to 80% LTV.

80%

Loan to

value

Loan to

value

10

Days or

less to close

Days or

less to close

$4M

Max loan

amount

Max loan

amount

Bridge Loan

Requirements

Our bridge loan lending team at Revolution Realty Capital has funded over $1 Billion in deals.

Our short term bridge loans are designed for projects that don’t require rehab. We offer no prepayment penalty, up to 80% loan to value (LTV) ratio and higher LTV’s for proven borrowers, 80% loan to cost (LTC), plus quick pre-approvals for fast funding.

- Loan Amount

- $100K - $4M

- Rates

- Starting at 9.5%

- Max Loan to Value

- Up to 80%

- Max Loan to Cost

- 80%

- Personal Income Requirements

- None

- Prepayment Penalty

- None

- Term

- 12 month term and I/O up to 5 years (no amortization period)

- Eligible Properties

- Non-owner occupied single family properties, townhomes, multi-family properties, and mixed-use properties (50%+ of square footage is residential)

- Number of Units

- No limit

Small Balance Commercial

Lending Nationwide

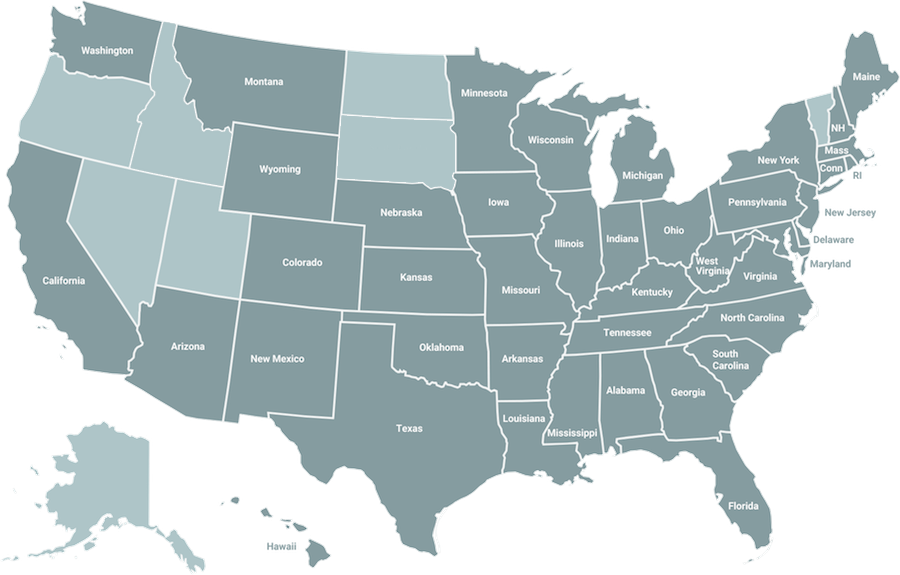

We offer private commercial bridge loans in 42 of 50 states including Washington DC.

Apply now for bridge loans in California, Arizona bridge loans, bridge loans in Florida, and Texas bridge loans.

What is a

Bridge Loan

Bridge loans — also called interim financing, gap financing, or swing loans — are short term loans designed to provide immediate funds during a transition period while waiting for permanent funding on properties that don’t require rehab. Typically, bridge loans are secured with another property as collateral.

Commercial bridge loans are effectively fix and flip loans without the renovation component. Bridge lending is not typically offered by banks or credit unions and instead offered by private lenders, hard money lenders, and specialty finance companies.

Bridge loan lenders consider the following for investors applying for bridge financing:

- Real estate investment experience

- Credit score

- Clean criminal and financial background

- Size of the down payment

- Liquid reserves

If you’re new to bridge loan lending, learn how to calculate real estate ROI.

How Does a

Bridge Loan Work

Commercial bridge loans provide fast funding for properties that don’t require rehab, or for properties where rehab is already complete, typically during a transition period to a longer-term loan. Oftentimes, private bridge loans for commercial properties are based on the LTV.

The typical LTV from commercial bridge lenders is 70%. At Revolution, we offer up to 80% LTV on private bridge loans for proven borrowers.

Not an investor but looking to make huge returns on bridge loans? Become a bridge loan broker with Revolution Realty Capital for access to industry-leading private short term loans.

Benefits of

Bridge Loan Financing

Private short term bridge loans create an opportunity for investors to earn their returns on properties that don’t need renovation faster than traditional bank lending.

Commercial bridge loans from private lenders have a fast closing process with more flexible terms than traditional lenders, which don’t typically offer this short term financing.

Benefits of Revolution’s bridge looan lending include:

- Fast pre-approval process

- As little as 10 days to close

- Up to 80% LTV

- Up to 80% LTC

- Funding between $100K – $4M

- No prepayment penalty or exit fee

- Access to our state-of-the-art online platform for borrowers

- Nationwide lending in 42 of 50 states

- 12 month terms, I/O up to 5 years with no amortization period

- No personal income requirements

If you need gap financing for your real estate project, apply now, and let’s talk about your deal.

We offer a fast and simple application process for our commercial bridge loans.

Step 1

Step 1

Complete the form on the left to connect with our world-class team of bridge loan lenders.

Step 2

Step 2

Our commercial bridge loan lenders will reach out to you in 24 hours with a funding solution customized to suit your specific deal.

Step 3

Step 3

Complete the application through our

simple online bridge loan lending

platform to get approved in as little as 10 days.

Best Bridge

Loan Lenders

Revolution Realty Capital offers the best commercial bridge loans for real estate investors. We offer higher LTV for proven borrowers, up to 80% LTC, 10 days or less to close, and no personal income requirements with rates starting at 9.5%.

When you choose to fund your non-owner occupied SFR, townhome, multifamily, or mixed use property with Revolution, you get access to our team of professionals with over 40 years of real estate experience and our intuitive borrower portal.

Explore More Private Loans for Investors

-

SMALL BALANCECommercialLearn More

-

TERMRentalLearn More

-

NNNBuild to SuitLearn More

-

REHABFix & FlipLearn More

-

GROUND UPConstructionLearn More

Learn About Commercial Bridge Loans

Not ready to fund your short term bridge loan? Gain knowledge from experts about how to become a real estate investor in our learning hub.