Rental Loansfor Investors

Nationwide non-bank private lender providing institutional grade short term rental loans, long term rental loans, and multi-family loans for real estate investors

80%

As-is value

As-is value

30

Days or

less to close

Days or

less to close

$3M

in funding

property

in funding

property

Loans for Rental Property Requirements

We've financed over $1 Billion in deals at Revolution Realty Capital.

We offer between $100K — $2M for eligible properties for 1 – 1,000 units including non-owner occupied single-family, townhomes, multi-family, and mixed-use where 50%+ of square footage is residential with a minimum 10% down payment and 620 FICO score.

Our rental financing features no income verification requirements, funding for up to 80% of as-is value, and quick closings in as little as 10 days.

- Loan Amount

- $100K - $3M

- Leverage

- Up to 80%

LTV - Term

- 30 year fixed, I/O, and ARM options

- Lien Position

- 1st Lien

- DSCR Requirement

- As low as 0.80x

- Number of Units

- Rental property financing

for 1 – 1,000 units - Down Payment

- Minimum 20%

- Credit Score

- Minimum 620 FICO

- Prepayment Penalty

- 1-5 Years and No prepayment option

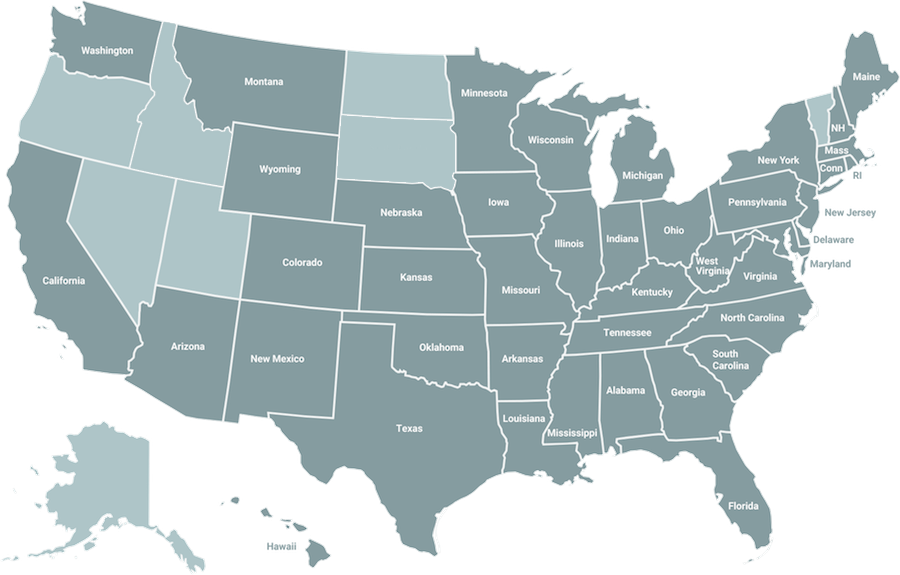

Rental Property Lender Nationwide

We offer rental property loans in 42 of 50 states including Washington DC.

Apply now for your direct private loan in:

What Are Investment

Loans for Rental Property?

Rental loans — also called short term rental loans, long term rental loans, multifamily loans, and apartment loans — are private money loans for tenant-occupied single family, multi-family, and mixed-use properties. Typically, properties must be rent-ready when securing rental house financing.

Multi-family lenders consider the following for investors applying for rental property funding:

- Property status (e.g. rent-ready)

- Real estate investment experience

- Credit score

- Clean criminal and financial background

- Size of the down payment

If you’re new to rental loans for investors, read our guide to loans for rental property.

Using Private Loans

for Rental Property

Rental loans provide funding to cover up to 80% of the as-is value. The cap rate for rental loans for investors is determined by who the tenant is, if the loan is rated or non-rated, whether you're a corporate or individual borrower, and if the loan is local, regional, or national.

Typical LTV requirements from multi-family lenders is between 66 – 73%. At Revolution, we offer up to 80% LTV on rental loans for proven borrowers with 30-year fixed, I/O, ARM, and portfolio term options.

Benefits of Rental

Property Loans

Financing for rental properties creates an opportunity to generate a steady income with tax advantages. Generally, there are many options to secure loans for rental property including conventional loans, FHA and VA loans, portfolio loans, and private money loans.

Benefits of Revolution’s fix and flip loans include:

- Fast pre-approval process

- As little as 10 days to close

- Higher LTV for proven borrowers

- 90% LTC funding

- Flexible terms with up to 100% rehab

- Funding between $100K – $10M

- No prepayment penalty or exit fee

- Access to our state-of-the-art online platform for borrowers

- Nationwide lending in 42 of 50 states including Arizona, Florida, Texas, and California investment property loans

Our primary goal is helping investors realize the best ROI for rental properties through a fast and easy loan process.

If you’re ready to fund your short- or long-term rental property loan, apply now, and let’s talk about your deal.

We offer a fast and simple application process for our rental loans.

Step 1

Step 1

Complete the form on the left to connect with our world-class investment property lending team.

Step 2

Step 2

Our term real estate lenders will reach out to you with a funding solution personalized to suit your specific deal.

Step 3

Step 3

Complete the application through our online property lending platform for borrowers.

Best Loans for

Rental Property

Revolution Realty Capital offers the best short, long, and multifamily rental loans for real estate investors. We offer higher LTV for proven borrowers, up to 80% of as-is value, quick closings and pre-approvals, and no personal income requirements with rental property loan rates starting at 6.875%.

When you choose to fund your investment rental property with Revolution, you get access to our team of real estate professionals with over 40 years of experience and our user-friendly borrower portal.

Explore More Private Loans for Investors

-

RehabFix & FlipLearn More

-

BRIDGEAcquisitionLearn More

-

NNNBuild to SuitLearn More

-

SMALL BALANCECommercialLearn More

-

GROUND UPConstructionLearn More

Learn About Investment Loans for Rental Property

Not ready to fund your rental property or looking for inspiration for your next term rental project? Gain knowledge from on-the-ground real estate experts about how to become a real estate investor in our learning hub.